For UK investors, finding truly profitable and low-risk opportunities is becoming harder. If you’re a UK investor looking at your net returns and wondering why you’re keeping less every year, you’re not imagining it. Taxes are rising, yields are shrinking, and regulations are tightening. But imagine earning rental income and keeping every single pound, with no deductions for the taxman. That is the incredible opportunity Dubai offers with its tax-free rental income, a clear advantage drawing investors globally, especially those in the UK who are keen to see their returns truly maximized.

In this guide, we’ll explore why Dubai’s real estate market is such a solid option for British investors, including the growing focus on developments that are built with the environment in mind. Whether you are just starting to look at the market or are ready to invest, this information will help you make a more profitable decision.

Why Dubai is a Prime Destination for UK Real Estate Investors

For many years, UK investors have trusted London as their primary real estate market. But in recent times, more and more investors have turned their attention to Dubai, and for good reason. It’s not just about the weather or luxury properties. Dubai offers something that the UK market simply can’t: tax-free rental income.

Dubai sits between East and West and has turned into a top global hub for business, tourism (Dubai welcomed 17.15M visitors in 2023 – supporting Airbnb-level yields), and trade (over 300,000 new businesses registered in 3 years), which makes it a good place for investment.

Because so many people move there for work (with 100,000 residents added annually and projected to reach 5.8M by 2040, with 90% of residents renting), housing demand keeps growing, pushing rental yields up. In Dubai, landlords don’t pay taxes on rental income, capital gains, or property, so you get to keep all the money your property earns.

Why UK Investors Are Redirecting Capital to Dubai

| UK Market Reality | Dubai Market Advantage |

| Rental profits have dropped by up to 26% since Section 24 (HMRC) | 0% tax on rental income |

| Net yields average 2.5–3.5% (Zoopla 2024) | Rental yields are 6–12% depending on property type |

| Landlord costs are rising 8–12% annually | 0% capital gains tax |

| Slow capital appreciation | 48% price growth in prime areas over 24 months (Knight Frank) |

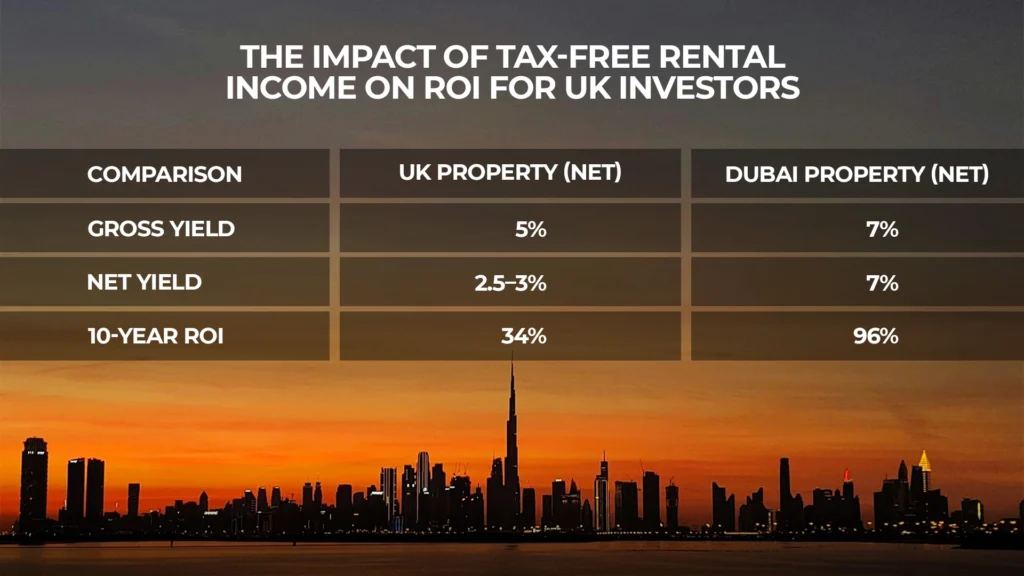

The Impact of Tax-Free Rental Income on ROI for UK Investors

Dubai doesn’t tax people on rental income (or on property sale profits), so if your property yields 7%, you keep the full 7% without income tax eating into it.

That makes investing in Dubai property especially attractive, since your returns stay intact letting you reinvest and grow your money faster

| Comparison | UK Property (Net) | Dubai Property (Net) |

| Gross Yield | 5% | 7% |

| Net Yield | 2.5–3% | 7% |

| 10-Year ROI | 34% | 96% |

That makes investing in Dubai property especially attractive, since your returns stay intact, letting you reinvest and grow your money faster.

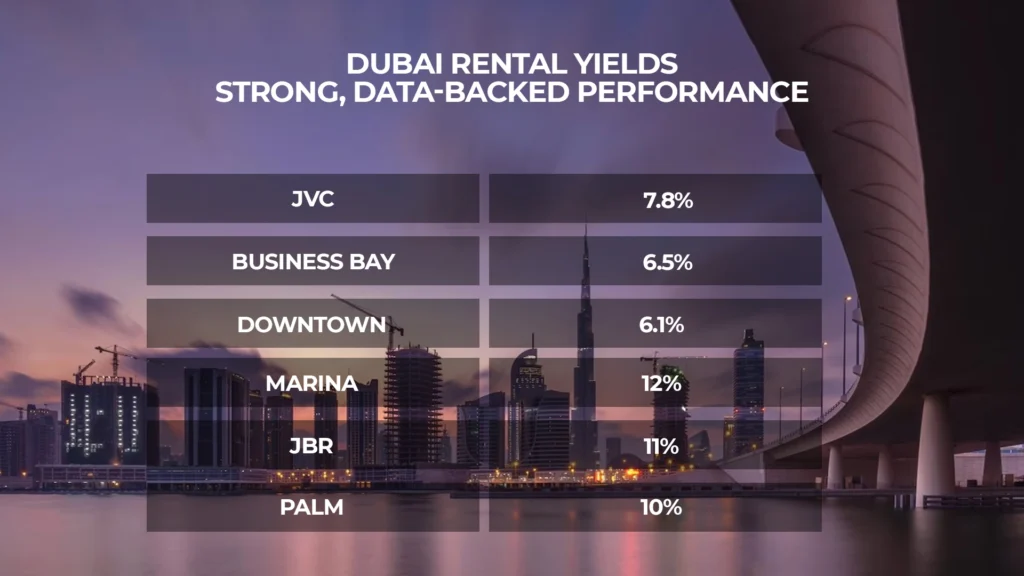

Dubai Rental Yields: Data-Backed Performance

The city’s high demand is reflected in strong yields across key areas:

- Long-Term Rentals: JVC: 7.8% / Business Bay: 6.5% / Downtown Dubai: 6.1%

- Short-Term Rentals: Dubai Marina: 12% / JBR: 11% / Palm Jumeirah: 10% (AirDNA 2024)

How Sustainable Developments in Dubai Enhance Investment Potential

Sustainability isn’t just a trend; it’s the future of real estate, and Dubai is determined to be a leader. The government is investing heavily in eco-friendly developments, with the aim of making the city one of the most sustainable in the world.

For investors, this offers a great opportunity. Not only are sustainable properties better for the planet, but they also offer enhanced long-term value. Green buildings typically attract more desirable tenants who are looking for energy-efficient homes and the benefit of lower utility bills. Who does not want to save money on energy?

In Dubai, sustainable properties are also likely to maintain their value better over time compared to older, less efficient structures. By investing in green developments now, you’re making sure your investment will do well in the future, matching the city’s plans, and setting yourself up for steady growth over time.

Understanding Dubai’s Property Tax Laws: What UK Investors Need to Know

Investing in a foreign country can raise questions about taxes, but Dubai’s tax system is much simpler than the UK’s. The biggest benefit is that you don’t have to pay any income tax on the money you make from renting out your property, and there’s no tax when you sell it either. This is a huge plus for UK investors who want to keep all of their profits.

That said, there are a few fees to consider. The Dubai Land Department (DLD) charges a 4% fee based on the price of the property, kind of like stamp duty in the UK. Some buildings also have extra service fees for maintaining shared areas, but these can change depending on the building.

For UK investors, there’s a special agreement between the UAE and the UK that stops you from being taxed twice on the same income.

As always, consulting a qualified tax advisor is the best practice to ensure you meet all your specific UK tax obligations.

Iconic Towers for Great Income and Growth

These tall, impressive buildings are located in key business areas, which means they’re in high demand from renters. Being in prime spots helps increase their value over time.

- Burj Al Aziz (Azizi Developments): This project will be one of the tallest buildings in the world, located along Sheikh Zayed Road. It will feature a 7-star hotel, luxury apartments, and shops, making it a popular destination for wealthy visitors.

- Binghatti Skyrise: Located in Business Bay with amazing waterfront views, this property offers a 5.9% rental yield and strong tenant demand, making it a smart investment. Flexible payment plans, including 70% upfront, are also available.

- Danube Bayz: This 103-floor tower in Business Bay offers affordable luxury with flexible payment options, like paying 30% over 30 months. It’s an ideal choice for long-term investment.

How UK Investors Should Approach Dubai (Step-by-Step)

1. Clarify Your Investment Objective

Do you want immediate monthly income? Long-term Capital Growth? Or a hybrid model? This will guide your district choice.

2. Choose the Right District

- For Rental Income: Business Bay, JVC, Dubai Marina

- For Luxury Appreciation: Downtown, Palm Jumeirah, Dubai Hills

- For Short-Term Yields: Marina, JBR, Palm Jumeirah

3. Find a Specialist Advisor

Work with an agent who understands how to help international buyers. They can show you the best properties, explain the local market, assist with yield forecasting, and structure payment plans.

4. Understand the Legal Process

As a UK investor, you can buy property in Dubai’s freehold areas with just a valid passport. UK buyers need only a 10–20% deposit and the 4% DLD fee.

5. Explore Financing Options

UK investors can get mortgages in Dubai, but they usually can’t borrow as much as residents (typically 50-60% of the property price). Off-plan developer payment plans are another popular option.

6. Finalise the Purchase

Once you’ve picked your property, you’ll sign a Memorandum of Understanding (MOU), pay a deposit, and then finalize everything at the Dubai Land Department (DLD).

Potential Risks and How to Mitigate Them

Every investment comes with risks, and Dubai real estate is no exception. Here are some risks you should know about:

- Currency Fluctuations: The UAE Dirham is tied to the US Dollar. If the British pound drops in value, your purchasing power might go down too.

- Oversupply: Dubai is constantly building new properties. This means there’s a risk that too many new homes could flood the market at once, which might lower rental prices temporarily.

- Off-Plan Delays: While Dubai’s real estate market is currently favorable for investors, delays in off-plan property projects can occur from time to time.

How to Reduce Risks:

- Keep some of your rental income in AED (UAE currency) or USD (US dollar) to protect against a weak British pound.

- Focus on mature, high-demand districts. prime areas like Downtown Dubai or Palm Jumeirah, where demand is always high, making it less likely new buildings will hurt rental prices.

- Work with developers with a proven track record of 70–95% on-time handover performance.

FAQs

Is Dubai’s rental income truly tax-free?

Yes, Dubai offers 0% tax on rental income and capital gains, making it tax-free for investors.

Do UK investors pay UK tax on Dubai rental income?

UK investors are subject to UK tax on Dubai rental income, but the UAE–UK Double Tax Treaty prevents double taxation.

What returns should I expect?

Expect 6–8% long-term returns, with 10–12% for short-term or vacation rentals in prime locations.

What is the minimum investment amount?

The minimum investment for strong opportunities in Dubai’s real estate market is typically £150,000–£200,000.

Final Thought

If you’re a UK investor seeking strong, measurable, tax-free returns, Dubai delivers what the UK currently cannot. A market with high demand, consistent yields, rapid infrastructure growth, and a regulatory structure designed for investment, not restriction. Ready to explore Dubai’s market? Contact us today for expert help on investing in Dubai’s eco-friendly properties.