Dubai’s Golden Visa: The 10-Year Key Turning Investors into Residents

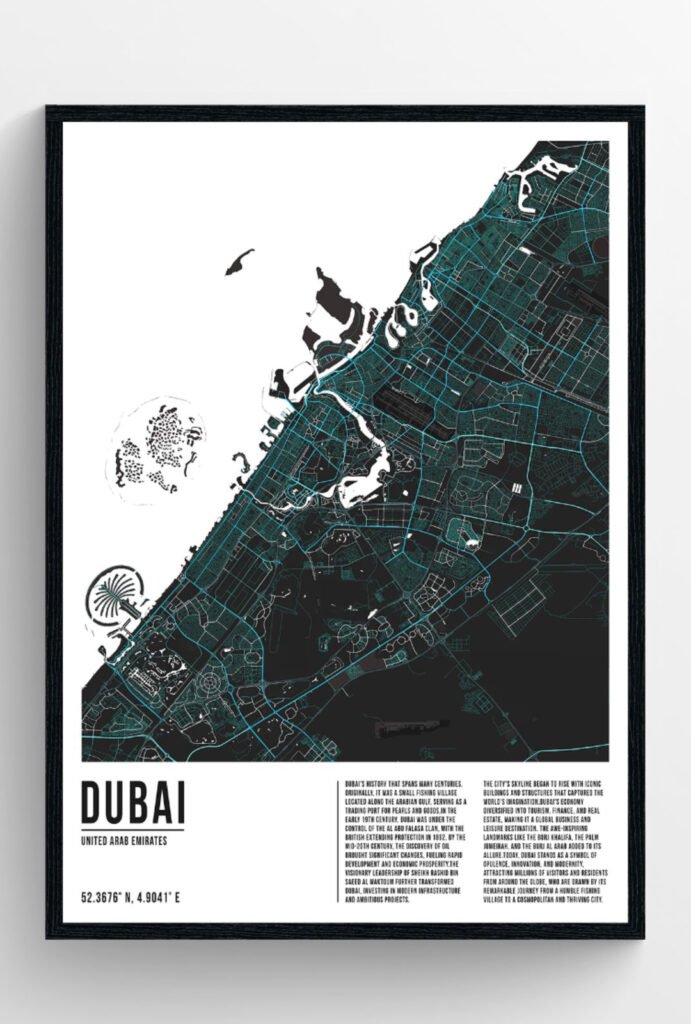

DUBAI The glass towers of Downtown Dubai, the marinas lined with yachts, and the sprawling new villa communities on the city’s edges all share one thing in common: they are now part of a residency revolution.

At the center is the Golden Visa, a decade-long residency permit introduced by the United Arab Emirates. Tied directly to real estate ownership, the program has transformed Dubai’s housing market from a short-term speculative playground into a magnet for long-term capital.

The numbers tell the story. According to Knight Frank, transaction volumes in Dubai climbed 40 percent year-on-year in early 2025, while average prime prices rose 14 percent. Rental yields remain among the highest in the world, outpacing London, New York, and Singapore.

For investors, the attraction is obvious: buy property worth at least AED 2 million ($545,000), and residency comes with it.

What the Golden Visa Offers

The threshold is straightforward. Investors who own property worth AED 2 million or more, whether a single luxury apartment, a portfolio of studios, or even off-plan homes under construction can apply. Mortgaged assets count, provided the paid-up value meets the bar.

Spouses and children are typically included. In some cases, parents can be sponsored too. Once approved, the visa is valid for 10 years and renewable.

The application process is largely bureaucratic — fingerprints, photos, medical tests in waiting rooms faintly scented with disinfectant — but it rarely takes more than six weeks. VIP services cut that in half.

How It Shapes Investment Returns

The visa isn’t just about lifestyle security. It is altering the financial dynamics of Dubai’s housing market:

- Cheaper Mortgages: Banks view long-term residency as stability. Holders often enjoy a 0.5 to 0.7 percent reduction in mortgage rates.

- Tighter Supply: Long-term landlords hold units longer, reducing speculative turnover and supporting rent growth.

- Bigger Buyer Pool: Retirees from Europe, founders from India, and remote workers from North America now see Dubai as a base rather than a bet.

“These buyers are less interested in flipping and more in anchoring their lives here,” said a Dubai-based property analyst."

Investor Stories

A German engineer in his mid-40s bought a AED 2.4 million townhouse in a lagoon development on a post-handover plan. He expects to rent it out from 2027, financing costs lowered by a 0.6 percent rate cut.

A Malaysian venture capital couple combined the deeds of two AED 1.1 million Marina studios to qualify. They lease them on short-term platforms, yielding around 8 percent gross.

An Egyptian surgeon, age 52, purchased a Palm Jumeirah apartment for AED 2.7 million. He splits his time between Cairo and Dubai, renting it seasonally for a 6 percent annual return.

These profiles reflect a shift: real estate as a gateway to residency, not just profit.

Where the Money Flows

The city’s neighborhoods tell a story of both maturity and frontier:

- Downtown Dubai & Business Bay attract corporate tenants and liquid investors.

- Dubai Marina & JBR remain short-term rental powerhouses, delivering 7 to 11 percent yields.

- Dubai Hills Estate & Palm Jumeirah appeal to families and high-net-worth buyers seeking long-term appreciation.

Emerging areas MBR City, Bluewaters, and Al Jaddaf are drawing speculative but increasingly institutional interest, with infrastructure still catching up to ambition.

Myths and Realities

Not all assumptions about the Golden Visa hold true.

- Cash only? Mortgages qualify. Banks provide valuation letters.

- Residency requirements? A single entry every six months suffices.

- Sell the property, keep the visa? No. Residency ends if holdings fall below AED 2 million.

- Developers handle the paperwork? Some do, many do not. A professional agent is often essential.

Risks: Off-Plan vs. Ready

Off-plan properties are eligible once 50 percent of value is paid but carry construction risks. Ready properties qualify at once, though subject to market cycles.

For investors, the choice is between discounted early entry with delays, or instant rental income with a higher upfront cost.

Why Now

Dubai’s supply pipeline is tightening. Prime neighbourhoods face a shortage of new stock, even as demand rises from Europe, Asia, and North America. Analysts at JLL warn that inventory gaps could push rents and prices higher through 2026.

Add to this the visa’s appeal tax-free status, banking access, and long-term certainty and Dubai’s market looks less like a speculative outpost and more like a cornerstone of global wealth strategy.

In the words of one London-based wealth manager:

“You’re not just buying property in Dubai. You’re buying a base — in one of the most connected, investor-friendly cities in the world.”

Explore:

Freehold vs. Leasehold in Dubai

Why Investing in Dubai Real Estate Beats Buying Designer Brands.

👉 Ready to invest smart? Contact Us Today