Dubai Property Investment 2025: The British Investor’s Passport to Off-Plan and Residential Gold

“In Dubai, real estate isn’t simply bought, it’s curated, staged, and designed to perform.”

As the UK’s once-stalwart property scene weathers tightening legislation, rising costs, and underwhelming yields, the savviest British investors are pivoting toward a skyline shimmering with possibility: Dubai. This isn’t just another overseas market, it’s a carefully choreographed fusion of architectural drama and economic precision.

According to Knight Frank’s Q1 2025 Market Update, off-plan transactions now make up 69% of all sales, with prices an impressive 17.6% above their 2014 peak. Add zero capital gains, inheritance, or annual property taxes to the equation, and Dubai’s proposition becomes not just attractive it’s irresistible.

Why Dubai Commands British Capital

The UK’s appeal is fading under the weight of 3–4% average yields in its major cities and an ever-complex regulatory web. By contrast, Dubai delivers:

Tax-Free Income

Superior Rental Yields

Ease of Ownership

Currency Leverage

The Off-Plan Advantage: Investment as Art

For British investors, Dubai’s off-plan market is not a reckless gamble it’s a disciplined, phased investment strategy. With payment structures like 60/40 or 70/30 and in some developments, post-handover schedules buyers can secure high-value assets with lighter upfront capital.

Securing an off-plan Dubai property is like ordering couture—you claim it before the debut, and watch its value rise before completion.

Savills’ 2024 Global Cities Report highlights the liquidity and flexibility of off-plan holdings: the ability to resell before completion or retain for rental income gives investors a versatility often missing in heavily regulated Western markets.

Prime Locations for 2025 Investment

- Dubai Marina – Waterfront glamour meets year-round tenant demand; the short-let market is consistently vibrant.

- Business Bay – A hybrid of corporate prestige and luxury living.

- Jumeirah Village Circle (JVC) – Accessible pricing with strong yield and appreciation potential.

- Downtown Dubai – Prestige anchored by the Burj Khalifa; long-term growth plus prime holiday-let potential.

Vogue Living Trend Box: 2025’s Property Hot List

Trend 1: Skyline Status : Branded residences with hospitality tie-ins are attracting record premiums.

Trend 2: Flexible Luxury : Post-handover payment plans make luxury ownership accessible to a broader investor class.

Trend 3: Micro-Market Mastery : Sub-districts within Business Bay and Dubai Marina outperforming their broader postcode averages.

Risk Management: Precision in Dubai’s Real Estate Market

- In Dubai’s dynamic real estate market, disciplined due diligence is paramount for successful investment.

- Proven Developers: Transparency and a proven track record of delivery are more crucial than extravagant renderings.

- Micro-Market Analysis: Different districts experience varying growth rates; therefore, it is essential to delve into building-level data for accurate insights.

- Resale Regulations: Familiarise yourself with lock-in periods and resale eligibility for off-plan properties.

- Currency Exposure Hedging: Maintain a strategic approach to managing GBP/AED exchange rates.

The British Investor’s Roadmap

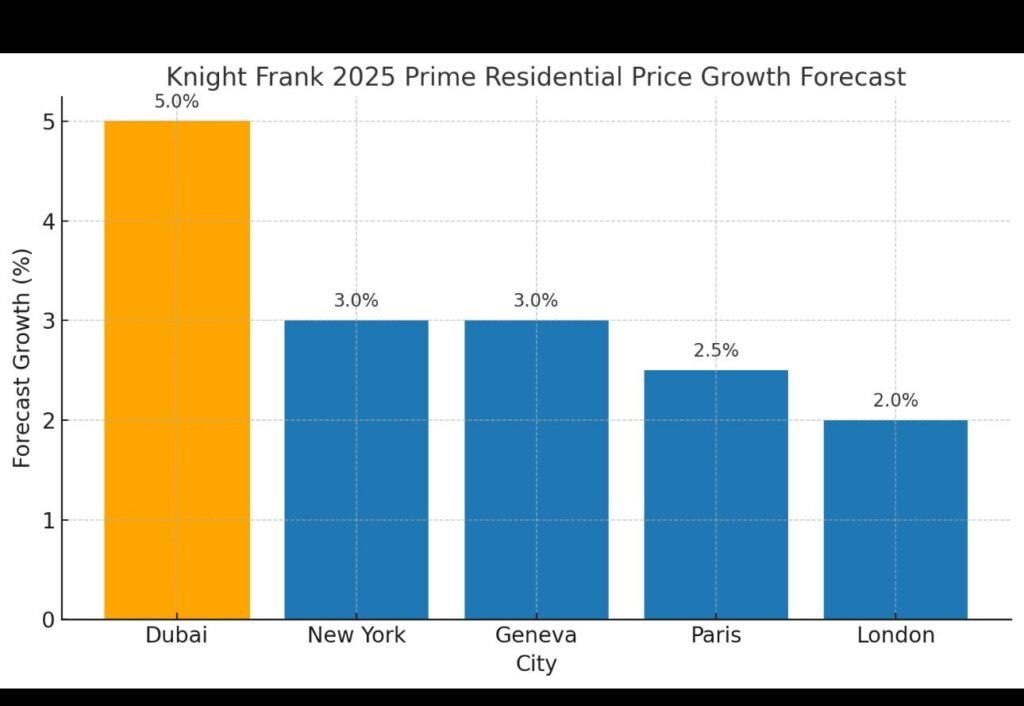

- Dubai continues to dominate with a projected 5% growth, supported by tight luxury inventory, strong population inflows, and escalating demand for high-net-worth properties.

- New York and Geneva, each forecasted to grow by approximately 3%, remain attractive as safe-haven destinations with chronic stock shortages bolstering prices.

- Paris shows a moderate 2.5% rise, benefiting from a weak euro and renewed interest from international buyers.

- London edges out at 2% growth, grounded by a relative value proposition for foreign buyers and resilience in its prime property segment, despite macroeconomic headwinds.

Market Outlook: 2025

Despite a substantial increase in average property prices of nearly 60% between 2022 and early 2025, Fitch Ratings anticipates a potential correction. They forecast a decline of up to 15% in the second half of 2025 and into 2026. The primary factor behind this projection is an anticipated surge in housing supply, with approximately 210,000 new units expected over the next two years, potentially surpassing demand growth.

Despite this risk of moderation, Dubai’s property market demonstrates notable resilience. The city’s financial institutions and prominent developers have strengthened their positions compared to previous cycles. Furthermore, demand for luxury residences in prime locations such as Palm Jumeirah and Downtown Dubai remains robust. This combination of prudent caution and enduring demand underscores Dubai’s status as one of the most closely monitored property markets globally.

Final Word

Dubai’s real estate market extends beyond mere property sales; it presents a platform for investors seeking opportunities.

For British investors, Dubai offers a unique combination of tax advantages, capital appreciation, and lifestyle exclusivity. Whether it’s a sophisticated apartment in the heart of Downtown Dubai or a high-performing JVC unit, the 2025 market is poised to welcome those who possess the requisite expertise and ambition to seize their moment.

Explore:

“In real estate, as in fashion, timing is everything and Dubai is having its haute couture moment.”